Power to the battery, or not?

This year certainly won’t be the first year in which electric tractors are introduced. 2022 will however be the first year in which the first factory-made electric farm tractors will be sold. And it’s not the obvious brands who are the pioneers!

In the ‘green fuels’ series, Future Farming is taking a closer look at energy sources that can help farmers run their tractors and machinery more sustainable or even climate neutral. The first episode focussed on methane as an alternative energy source to diesel. The second episode focussed on hydrogen and showcased quite some interesting insights in why (not) to choose for internal combustion engines or fuel cell technology.

This third episode explains what battery electric vehicles could bring and not bring. A parallel with the other green fuel solutions is that it’s not the major tractor manufacturers who are at the forefront.

Several projects and concepts

The past decades showed some initiatives by less prominent and by prominent tractor manufacturers concerning battery electric vehicles (BEV’s). Certainly prominent are John Deere’s concepts including the 7530 E Premium SESAM from 2008, the GridCON (2018), the Joker (2019) and the GridCON 2 platooning electric robot tractors swarm (2021).

To the latter three, John Deere recently explicitly stated: “The Joker and all our other electrification projects are studies in order to gather more experience in the field of electrification. The company doesn’t intend to release these vehicles in the near and middle future.”

The abbreviation SESAM stands for Sustainable Energy Supply for Agricultural Machinery and mid-March, John Deere premiered a video of a working prototype of its SESAM 2. A 1,000 kWh (!) battery powered autonomous traction unit with a (dis)connectable cab to drive it to a field manually where it can pull implements and machines autonomously. SESAM 2 can also provide power to other machines enabling machinery swarms.

Text continues underneath video

Meanwhile it also introduced its eAutopowr transmission that can provide 100 kW electrical power for driving implements and axles. The tractor drives fully electric up to 5 km/h and is an important step towards electrification, so Deere says. It’s optionally available on 8R, 8RT and 8RX models only and costs an additional € 20.533 on top of the E23 transmission.

Fendt first showcased its electric e100 Vario at the Agritechnica in 2017. The e100 delivers 68 hp based on a 600 kg 100 kWh battery composition and was destined to go into serial production in 2020. But Fendt first postponed the introduction to 2022 and later to 2025. Early February this year, the final series production date was communicated: 2024. The tractor will be manufactured in Fendt’s plant in Marktoberdorf, Germany and 1,000 units are said to be planned. Pricing details haven’t been disclosed yet.

Text continues below image

Small and local for starters

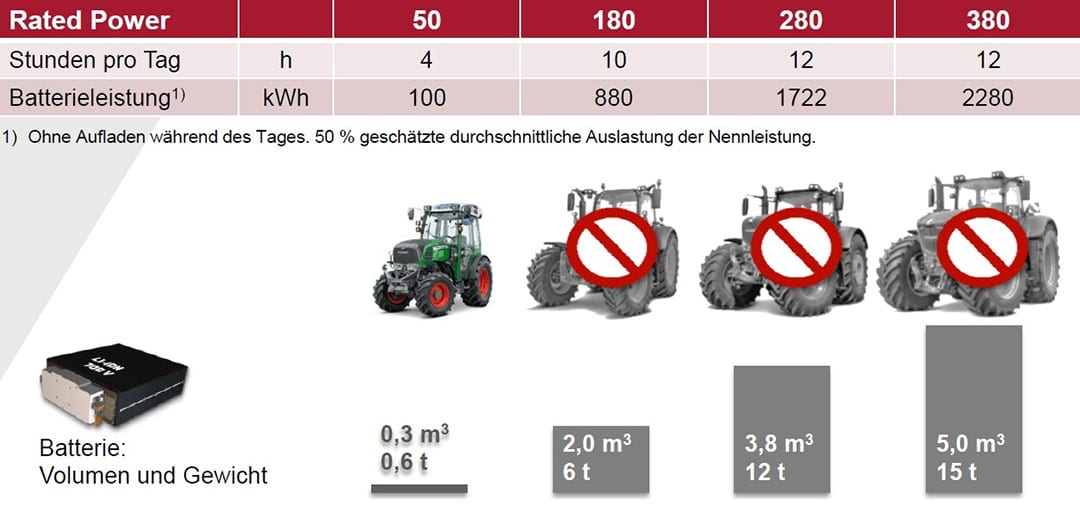

Fendt explained on multiple occasions why it first introduces a small electric tractor similar to the current 200-series and their approach can be considered as typical. Leonard von Stillfried, director premium tractor platform at Agco recently shared that in a German webinar. “Typical users of smaller tractors don’t expect them to work 12 hours in a row pulling a large disc harrow for instance. 4 working hours before recharging the 100 kWh batteries is acceptable. Users of larger tractors expect 10 to 12 hours of uninterrupted work and that would require batteries of up to 2,280 kWh. That’s 5 m3 of batteries weighing 15 ton.”

Text continues below image

Kubota Corporation President Yuichi Kitao told Nikkei Asia in an interview: “Not everything can be electrified. Mid-size or large farm machines might need to be fuelled by hydrogen”.

The above-mentioned initiatives and strategies are similar to those seen in construction machinery and specifically on excavators. That industry has seen a few early innovators, mostly Dutch, Norwegian and also Swiss importers and dealers transforming existing machines into BEV versions starting with the mini excavators. Their trigger was and is regulations and legislations banning combustion engine machines from city centres and indoor or tunnel construction activities. New brands have arisen such as Limach and Q-Lectra.

Today, most of the OEM’s offer full electric mini and midi excavators and some of the rebuilders have stepped up to transferring 20 – 30 ton excavators to full electric versions. Some of these even work for OEM’s such as ETEC, New Electric Automotive and Urban Mobility Systems.

Compared to farm tractors, excavators have a couple of advantages including primarily static operation, no pulling or driving of implements let alone ploughing! There’s also a huge difference with tractors and that’s the need of a rear contra weight. Existing contra weights can quite easily be replaced by heavy batteries and some customers are even keen on adding extra weight… This too explains why there’s already a lot of full electric telescopic loaders and mini shovels on the market.

Text continues below image

3 parallels to other sectors

But there’s also parallels to what happened in construction machinery. Even a parallel to the car industry and that’s a lot of new entrants, new brands. Some who have already become well-known such as Tesla and Polestar, but also Lucid, Rivian and Lightyear. And quite a few new Chinese brands as well including Aiways, Lynk & Co, MG, Nio and Xpeng.

In farming, among others these new brands have shown (production) models of full electric tractors: Monarch Tractor (US), Sabi Agri (France), Solectrac (US) and ZY (Turkey). And then there’s several concepts such as Emotive (UK). Let alone the numerous robot manufacturers marketing electrically powered field robots.

Another parallel with the construction machinery market is that most manufacturers initially develop small electric models. This includes Farmtrac (India), Fendt, Knegt (The Netherlands), Monarch Tractor, Sabi Agri, Solectrac and also Swiss Rigitrac. Rumours are that the Turkish ZY tractor however has two electric motors, one of 150 hp for driving and another one also equal to 150 hp for PTO applications. That tractor however still has to be launched.

The third parallel is the transformation of existing machines into BEV versions by importers, dealers and rebuilders because of the initial market demand from a selected group of targeted customers. This is particularly valid for more powerful tractors ranging from 80 – 250 hp says Dutch Fendt specialist Agromec.

Text continues below image

The common idea that battery prices will continue to go down, is not shared by everyone. Even before the current issues in Russia and Ukraine started to influence the prices of a lot of materials and commodities, Lord Bamford, JCB’s Chairman said: “Battery prices for BEV’s will not be going down like politicians say. The main reason is that the raw materials required, such as lithium, cobalt and copper won’t come down in price.”

Rebuilders say that they have concrete demand from farmers and contractors who have solar panel and/or wind turbine installations. Mischa Bauman, CTO at New Electric Automotive: “Farmers with a surplus of solar energy only receive a relatively small amount of money for the energy they supply to the net and some have had to stop their wind turbines due to a lack of demand. For a farmer with a large solar panel installation, we rebuild a shovel to an all-electric model. His shovel runs on one battery while another is being charged by his solar panels. He can now produce food with on farm generated energy. That’s what I call sustainable food production!”

Fendt also explicitly mentions that their electric e100 Vario tractor can serve as a buffer to capture solar and wind energy. Storing on farm produced solar and/or wind energy in batteries (of farm machinery) indeed is a potentially interesting operation. Also efficiency wise, as according to the International Viticulture and Enology Society (IVIS) and InsideEVs.com, the so-called well to tank efficiency of BEV’s is 95% and 54% for FCEV’s (Fuel Cell Electric Vehicles). The overall efficiency of BEV’s is 77% and it’s 28% for FCEV’s.

Text continues below image

Join 17,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the agricultural sector, two times a week.