Will AI and precision agriculture lower farming costs?

Crop production in the US is facing significant cost pressures. After input costs rose 80-250% during the supply chain shocks associated with the coronavirus crisis and the Ukraine War, crop production costs hit record levels in 2022. Coupled with labor shortages, net farm income in the US is likely to drop 18% this year, according to U.S. Department of Agriculture (USDA) forecasts. Moreover, because US crop yields have plateaued during the past five to six years, as shown below, farmers are seeking innovative ways to lower costs and improve profitability.

According to the research of Arkinvest, Artificial Intelligence (AI) and Precision Agriculture (Ag) have the potential to reduce annual agricultural operating costs by more than 22% globally. AGCO Corporation, CNH Industrial, Deere & Company, and Komatsu, among other companies, are creating innovative solutions to boost farm productivity. Last year, Deere announced plans to launch a fully autonomous corn and soybean production system by 2030—beginning with the Autonomous 8R Tractor. According to our research, the company’s precision ag tools—particularly the ExactShot Planter and See and Spray Ultimate Sprayer—will play important roles in boosting farm productivity.

Lowering agricultural costs

The combination of See and Spray Ultimate Sprayer, ExactShot Planter, and autonomous technology should lower several agricultural costs. First, the amount of seed, fertilizer, and chemicals involved in farming could drop by ~27%, a reduction driven largely by a 60% decline in starter fertilizer – which accounts for ~3% of operating costs – and a 67-80% decline in herbicide costs – which accounts for ~12% of operating costs. Second, as autonomous technology takes over in-field work from humans, we estimate that labor costs, which account for ~8% of operating costs, could drop ~85%. Finally, our research suggests that predictive maintenance and more efficient field passes could reduce fuel, lubricant, electricity, and repairs by ~20%.

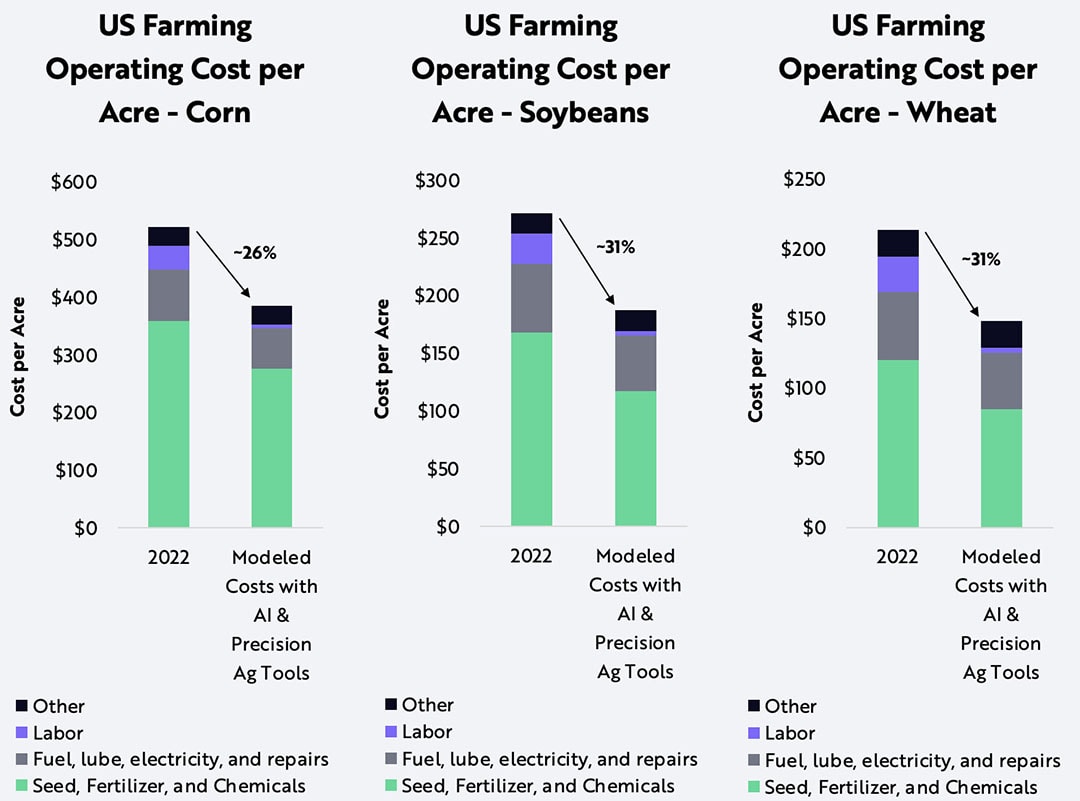

The combination of AI and Precision Ag could reduce the operating costs of farming corn, soybean, and wheat in the US by 26%, 31%, and 31%, respectively, on a per-acre basis, as shown below.

Text continues below graphic

Globally adoptation

ARK also estimates that 75-80% of farms will adopt these solutions globally, with different adoption rates based on factors like farm size, connectivity, and cultural differences. As agricultural companies leverage the various technologies and shift toward usage-based business models—reducing up-front capital costs and enabling per-acre charges—if 75% of farms were to adopt them, we believe worldwide farming operating costs could drop 22%. Potentially accelerating adoption, companies like Starlink are boosting rural connectivity with low-earth orbit satellite solutions.

Join 17,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the agricultural sector, two times a week.